Artificial Intelligence (AI) is capturing and scanning reams of sales data for predictive analytics, tracking consumer behavior and changing retail as we know it.

A Melissa Shoes salesperson uses the store’s facial recognition platform to offer a customer a more personalized shopping experience.

There’s a scene in the sci-fi movie Minority Report that must be every marketer’s dream. As Tom Cruise’s character hurries through a futuristic airport, sensors scan his eyes and holographic billboards pop up, calling out to him by name with product suggestions. How’s that for targeted marketing? While we’re not at the face-scanning stage yet, geofencing is a close second, and the rate at which brands and retailers are investing in gathering, analyzing and implementing consumer data shows we’re well on our way to a brave new world where AI will be as essential to retail as sidewalk sales. According to Coresight Research, 41 percent of retailers plan to invest in AI and machine learning solutions in the next year.

AI is something millions of consumers, especially younger generations, see as beneficial and not an invasion of privacy. In fact, there are about 650 million members of “Generation AI” (born after 2010 and currently spanning ages 5 through 9) who will begin spending their own money in the next decade. “And rather than having to research product specifications, ratings or prices, they will expect the best offerings to be preselected for them,” says Robert Hetu, an analyst for Gartner, a retail technology company. “Retailers that cannot successfully leverage prescriptive product recommendations will find themselves outside of the path to purchase.”

It’s one thing to be able to gather reams of data, but acting on it in a timely, accurate and profitable manner is where AI comes into play. AI helps data work harder and smarter for retailers. AI tools enable retailers to improve assortment and allocation planning, pulling in data on local and cultural trends, weather and sales statistics. AI helps retailers get the right product, in the right amount, at the right stores, at the right time.

“This improves overall supply chain efficiency and maximizes the chances that customers get the products they desire in the sizes they need,” says Michael Ferraro, executive director the FIT/Infor Design and Technology Lab. Such heightened accuracy will help reduce the overstocks and out-of-stocks that continually plague retailers, and smarter assorting will reduce markdowns and returns. Indeed, the incentives to incorporate AI technologies are strong. According to Retalon, a provider of predictive analytics and AI for retailers, when applied to inventory management AI can lower costs by as much as 25-40 percent. AI has also been shown to increase sales from 11-20 percent, while boosting turnover by up to 350 percent.

Making Bricks Like Clicks

Back in the day, if a brick-and-mortar retailer wanted to know how their customer behaved, they had to watch them and surreptitiously jot down notes. How did that consumer move through the store? Did he or she pick up a product, look at it and put it back on the shelf? How long did they linger? What in their basket did they pick up first? And some people think AI is creepy.

AI technology, in contrast, allows for a more accurate, continuous and behind-the-scenes tracking process. It allows retailers to gather data—like online dealers—to create a more efficient and entertaining shopping experience. “For years, the largest data void has been in-store—what happens from the front door to the register,” says Vedrana Novosel, director of product management for RetailNext, an in-store analytics company whose clients include Club Monaco and Sephora. “Full-path analysis [next generation sensors] eliminates the blind spots of in-store shopping, allowing retailers the ability to further test, learn and improve upon their delivered shopping experiences.”

“For years, the largest data void has been in-store—

what happens from the front door to the register.”

-Vedrana Novosel, RetailNext

Taking that effort to the next level is facial recognition technology. Melissa Shoes reports success working with Facenote to offer customers a more targeted in-store experience in four of its stores. Consumers who enter the store can opt in via snapping a selfie on a digital kiosk, or beforehand by tagging a selfie on social media. When they enter the store, their image and customer profile pops up for the salesperson, who then makes targeted recommendations. “We wanted to find the analog way to do in-store what websites have been doing all along, and that’s recognizing the customer as she comes in, then making suggestions based on her history,” says Beatriz Camacho, Melissa’s director of business development, noting it’s not unlike using cookies online to detect past consumer behavior. The key is to make such biometric programs work for the consumer, not just be a tech gimmick, so Melissa incentivized consumers with personalized discounts from $5 to $20 to try and increase engagement. Melissa Shoes increased foot traffic at its U.S. stores by 8 percent, while select stores saw a 55 percent increase in customer participation with a Boomerang-like video and recognition engagement program. “It really helped us close the sale in many cases,” Camacho says.

Customers are accustomed to being tracked and targeted online, but stores must be careful not to overstep privacy bounds. Eduardo Rivara, CEO of Facenote, advises companies to be absolutely transparent on how they’re going to use such technology and what the benefit is for the consumer. “On Facenote, the customer chooses when to opt-in, by providing a selfie, and can opt-out of the experience in one click and you are forgotten.” He adds that younger generations are more used to taking advantage of facial recognition technologies—like unlocking a smartphone with face ID. Still, broad acceptance is still in the early stages.

The On Demand Generation

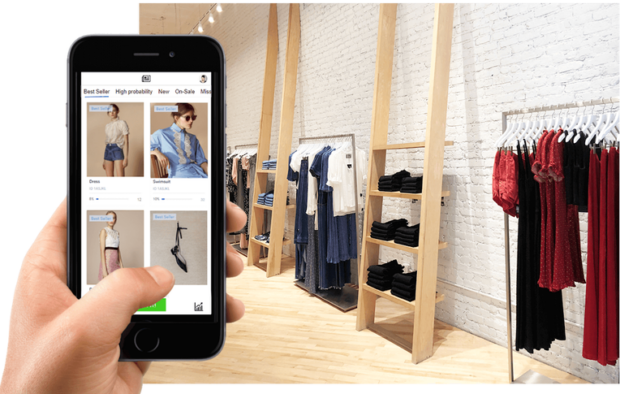

The ability to gather data is one thing, but what good is it if the lag time is too long or its dissemination is off the mark? Enter Mystore-E, which puts AI data directly in the hands of store managers and sales associates in real time. Its hand-held Tore-E system monitors and analyzes data from all digital channels, offering merchandising recommendations to stores so they can move best sellers into premium positions. For example, if a particular item is trending on the store’s Instagram page, staff is alerted so they can move such items to the front of the store. Tore-E also alerts the store if items are selling well together online, so sales associates can merchandise them next to each other.

Mystore-e offers digital data to stores in real time to assist with merchandising.

“Retailers have been in need to make their brick-and-mortar stores function more like websites; connecting touchpoints across channels by gathering, interpreting and translating omnichannel analytics into real-world solutions on the sales floor,” says Idan Sergi, co-founder and COO of Mystore-E, which won a Top Exhibitor Startup Award at Shop.org in 2018. “The idea is to bring online science into stores.”

In fashion-driven industries like childrenswear, one can’t underestimate social media’s growing influence on consumer shopping habits. It’s real-time data that AI can capture. “Thanks to advances in AI, retailers have made big leaps from analyzing data in hindsight to tracking and responding to it in real time,” says Carol Spieckerman, author of Navigating Retail From Now to Next. “The potential to eliminate out of stocks and efficiently move inventory to meet demand is exciting,” she adds. “This is particularly true at a time when social media can impact demand unexpectedly and as retailers fill online orders from stores.”

Other AI tools aiding retailers in their business include enhanced recommendation engines that can match apparel with appropriate accessories to complete a look. It’s similar to Amazon’s ‘Frequently Bought Together’ algorithm , which have reportedly increased the online giant’s revenue 7 percent. Bob Phibbs, a.k.a. The Retail Doctor, recommends the award-winning AI platform Increasingly, which helps retailers increase basket revenue by selling bundles, collections and looks. “It helps online merchants add on to orders across platforms from Google Shopping to social media,” he says. “Users are averaging a 15 percent increase in orders—not easy to do!”

Shoptiques, an online marketplace that sells merchandise from approximately 5,000 brick-and-mortar fashion and childrenswear boutiques, wants to help its clients see a broader picture as well. “Owners already have access to their store’s respective data via the software and the real-time reporting app, and one of my plans this year is to offer clients a retail report based on all of our users’ data with insights and industry recommendations,” says Maureen Dempsey, vice president of marketing.

Spieckerman, however, cautions about treating URLs and IRL’s (In Real Life) as one and the same. “It’s a mistake to take things too far,” she says, adding that bifurcation and differentiation between stores and online will become more important, not less. “The goal isn’t to make stores more like websites, rather to leverage store environments to create a unique experience that can’t be found online,” she says. “AI is going to allow retailers to do this without losing track of what shoppers are doing in both environments. That’s the near future of AI.”

Visual Search

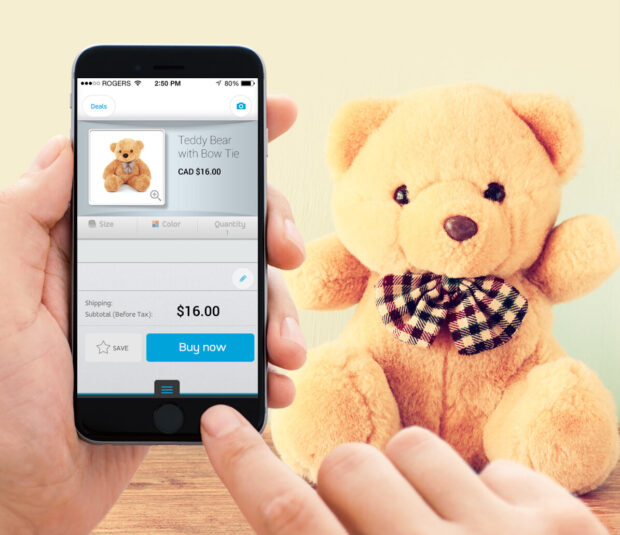

Visual search is another growing AI application, not surprising as consumers constantly covet what they see on Instagram, on celebrities and friends. Searching via images instead of words is key, especially for the digital generation.

Slyce, another visual search company, lets consumer search for items via images.

Visual search company Syte, for example, was co-founded by a woman who liked a dress in a magazine and figured there had to be a way to search for it online. Millions in venture capital funds later, Syte is now behind Farfetch’s award-winning “See it, Snap it, Shop it” feature. The platform helps shoppers find where it’s being sold and, if the item isn’t carried or is out of stock, the system makes “smart” recommendations for something similar. Syte’s clients also include Kohl’s, Pretty Little Things and BooHoo.

Syte is also taking its AI visual search to brick-and-mortar stores, testing out smart mirrors that offer alternative styles in store based on an uploaded image. “Visitors who engage with a ‘view similar’ on the product page have a conversion rate over 100 percent higher, and the average order value is 12 percent higher than those who do not,” says Andrew Thomson, Syte’s director of ecommerce.

Drowning in Data?

While data can be infinitely helpful to retailers, it can also be daunting, especially for smaller businesses that don’t have full departments to decipher and act on all the reams of (often) real-time information. “So much data about our customers and their buying behaviors comes into our hands daily, but sometimes it’s hard to organize the data and know what to do with it,” admits Liz Connor, owner of Pitter Patter in Louisville, CO.

At its simplest level, however, data can help retailers stay focused. “When you’re in a showroom and see all the shiny, new pretty things, it’s easy to forget what works and doesn’t in your shop,” Connor says. “The sensory overload and rose-tinted outlook are real! But having the vendor report cards handy helps me stay the course.”

Connor cites a recent example where data helped guide a buying decision. “We had an impression that a higher-priced line was just too high for us, but before I gave up on it we included it in our normal reporting routine before market and were surprised that the line had one of the strongest sell-through at almost full margin,” she says. “We upped our ordering with that brand for this spring, which was a risk I never would’ve taken without the data to back it up.”

Of course, not every piece of data is guaranteed gold. Site merchandisers often struggle to see the difference between data and behavior. While data doesn’t lie, analyzing consumer behavior for retail buying is a separate expertise.

“The data is a starting point and a framework of what the buy should look like, but we don’t work in a vacuum,” says Bridget Stickline, owner of Wee Chic in Maryland. “We buy against the indications of past data if the product is stronger than previous seasons or a silhouette trend dictates moving dollars from one class to another. There are a lot of factors that could dictate a shift, but as long as we are staying in our open-to-buy overall, those shifts tend to pay off.”

At the end of the day, data output is only as good as the data put in. “We have systems set up to track opportunities, but the reporting we churn out is only as good as the data we are feeding into the POS system,” confirms Connor. She is nonetheless pleased with what Pitter Patter has gathered thus far and is planning to expand business in the departments that data has proven out as strong growth areas. “If it weren’t for the three years of data we’ve collected, we wouldn’t even know in which direction to move,” Connor says. “Now that we have opportunities for growth, we just need to find the right location!”

Leave a Comment: