One question I am often asked by retailers is how to increase maintained margin—the difference between net sales and the net cost of the merchandise, which includes the cost of the goods, freight, stockroom expenses and adjustments for earned discounts. Several answers readily come to mind, the most obvious being to avoid overbuying and therefore reduce margin-eroding markdowns. Another way of increasing maintained margin is to find ways to increase the initial markup (IMU) placed on goods when received from the manufacturer.

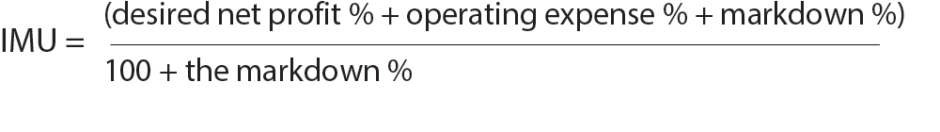

Typical IMUs for childrenswear stores range from 50 to 55 percent. (Over the past few years, the average percentage has risen as retailers forego trying to match discounters and try to cover rising overhead expenses.) The correct IMU is key to achieving the desired maintained markup. There are three areas that IMU must satisfy: 1. Desired net profit. 2. Operating expenses. 3. Markdowns. Here is a formula for determining IMU given those objectives:

Let’s say the net profit goal is 7 percent, operating expenses are 40 percent and markdowns are 18 percent of sales. Given the formula above, the IMU would have to be 55 percent to cover the markdowns, pay the overhead and still contribute 7 percent to the bottom line. If a store’s operating expenses are 52 percent, the net profit is reduced to 3.4 percent. That’s nearly a 50 percent reduction in profit. So the IMU must be enough in order to have to something left in the end.

It is a good idea to review pricing practices regularly. Competitive pressures, changes in operating costs and availability of promotional goods all come into play when deciding on an IMU. For example, are you making IMU decisions based on what a product will sell for or what you paid for it? One way to avoid falling into the trap of cost-based pricing is to determine the selling price when the order is written. In my previous retail career, I would often have our buyers decide what they thought they could sell a certain item for prior to knowing the actual cost. Once we knew the cost, we would make a decision to buy or pass on the item. Basing the retail price around the intrinsic value of the merchandise instead of its actual cost helped us to increase our IMU.

Don’t forget that IMU’s must also increase to sustain desired markup goals. Given ever-rising operating expenses, every SKU should be evaluated for increased IMU potential. Try this experiment: Determine how many items were sold last year. Calculate how much additional cash would have dropped to the bottom line if as little as 50¢ or $1 was added to each item. (Spoiler alert: You will be amazed!) Start doing this today with incoming stock and enjoy increased profits this year! —Ritchie Sayner

Ritchie Sayner is the owner of Advanced Retail Strategies, LLC, and an affiliate of Management-One. He is the author of Retail Revelations: Strategies for Improving Sales, Margins and Turnover. He can be reached at www.advancedretailstrategies.com

Leave a Comment: